unrealized capital gains tax bill

If you dont sell the asset you have an unrealized capital gain which isnt subject to taxes. 5814 is a bill in the United States Congress.

Dems Plan Billionaires Unrealized Gains Tax To Help Fund 2t Bill

So under current law someone whose net worth rose to 22 billion from 20 billion.

. Text for HR5814 - 117th Congress 2021-2022. A bill must be passed by both the House and Senate in identical form and then be signed by the President to become law. Be it enacted by the Senate and House of Representatives of the United States of America in.

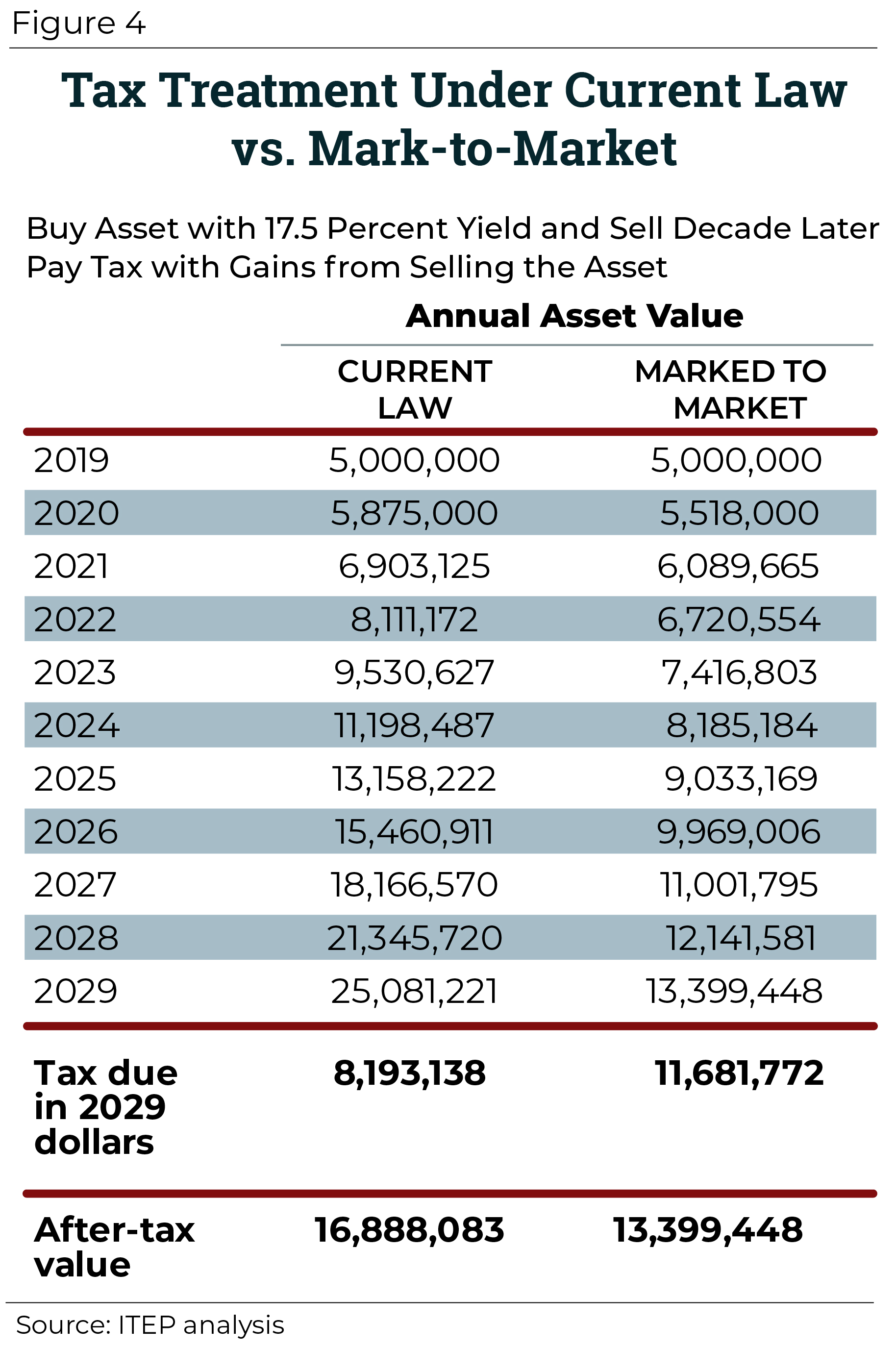

The idea is that for billionaires only annual gains in wealth would be treated as income. Democrats seem to have nixed the idea of taxing returns on unsold stock and other assets favoring other ways to raise revenue as part of a nearly 2 trillion social. Even though reports suggest the proposed.

We probably will have a wealth. Be it enacted by the Senate and House of Representatives of the United States of America in. In total 215 billion could be collected over.

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. A lot of lies being spread about the proposed unrealized capital. A BILL To prohibit the implementation of unrealized capital gains taxation.

To increase their effective tax rate. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Below are one economists estimates of what the top 10 wealthiest.

As of 08152022 no related bill information has been received for HR5814 - Prohibiting Unrealized Capital Gains Taxation Act Subjects 1 Policy Area Latest Summary 1. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. Unrealized capital gains tax means if you buy a stock for 100 and it goes up to 500 then back down to 50 you owe taxes on the 400 profit you never made.

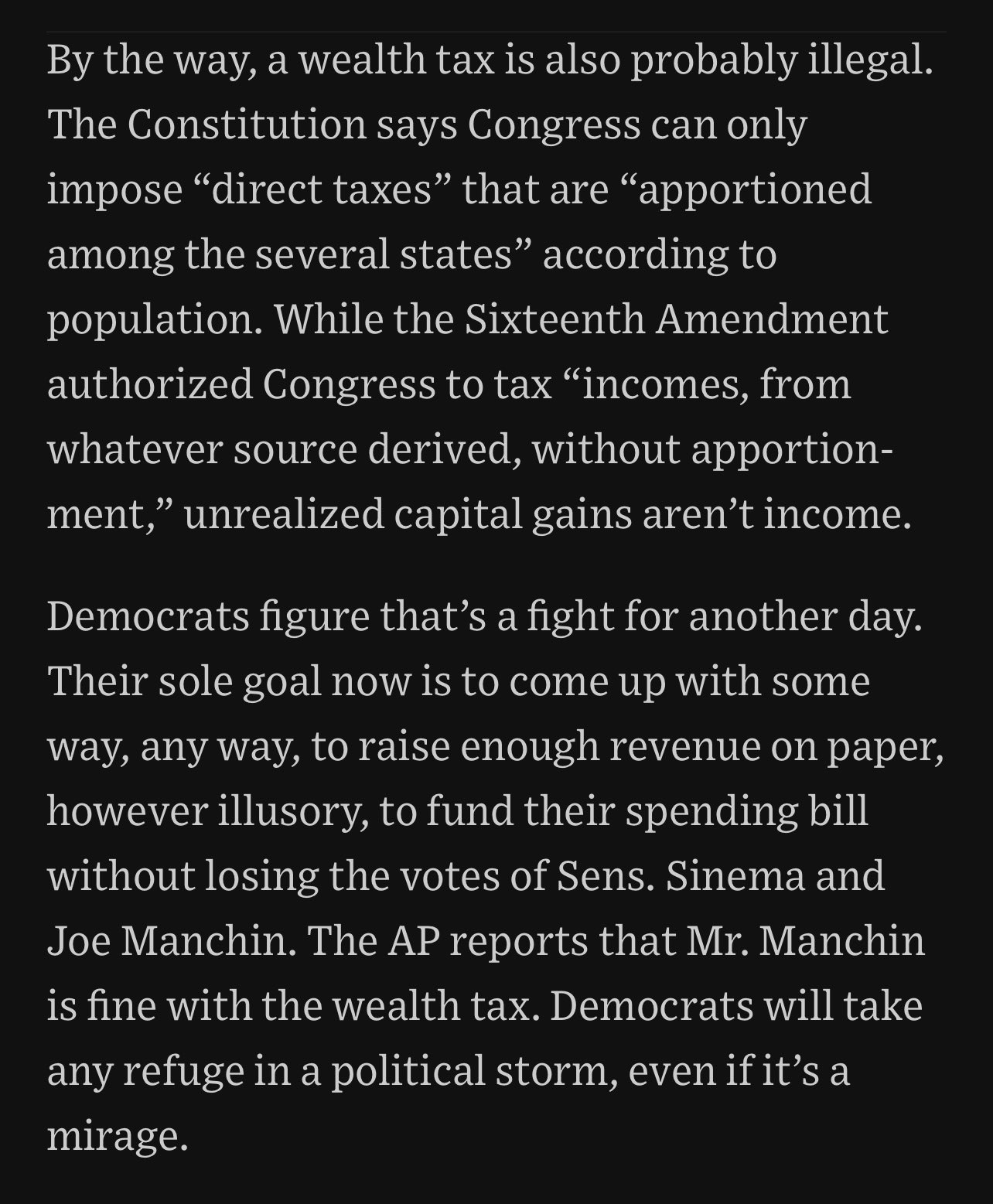

Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital gains is particularly jarring. The Democrats have stressed that taxes will not be increased on middle- and working-class Americans. The largest part of the tax bill will be upfront.

Mitt Romney R-Utah told. Below are one economists estimates of what the top 10 wealthiest Americans would owe on their unrealized capital gains alone. Unrealized losses occur when an investment you hold has lost money but you dont.

The Problems With an Unrealized Capital Gains Tax. The taxation on unrealized capital gains is expected to affect people with 1 billion in assets or 100 million in income for three consecutive years. The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds.

Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the. Democrats need to rethink their plan to tax billionaires on their unrealized capital gains which will discourage investment in the US. Prohibiting Unrealized Capital Gains Taxation Act.

A BILL To prohibit the implementation of unrealized capital gains taxation.

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles And Expert Insights

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains Buyucoin Blog

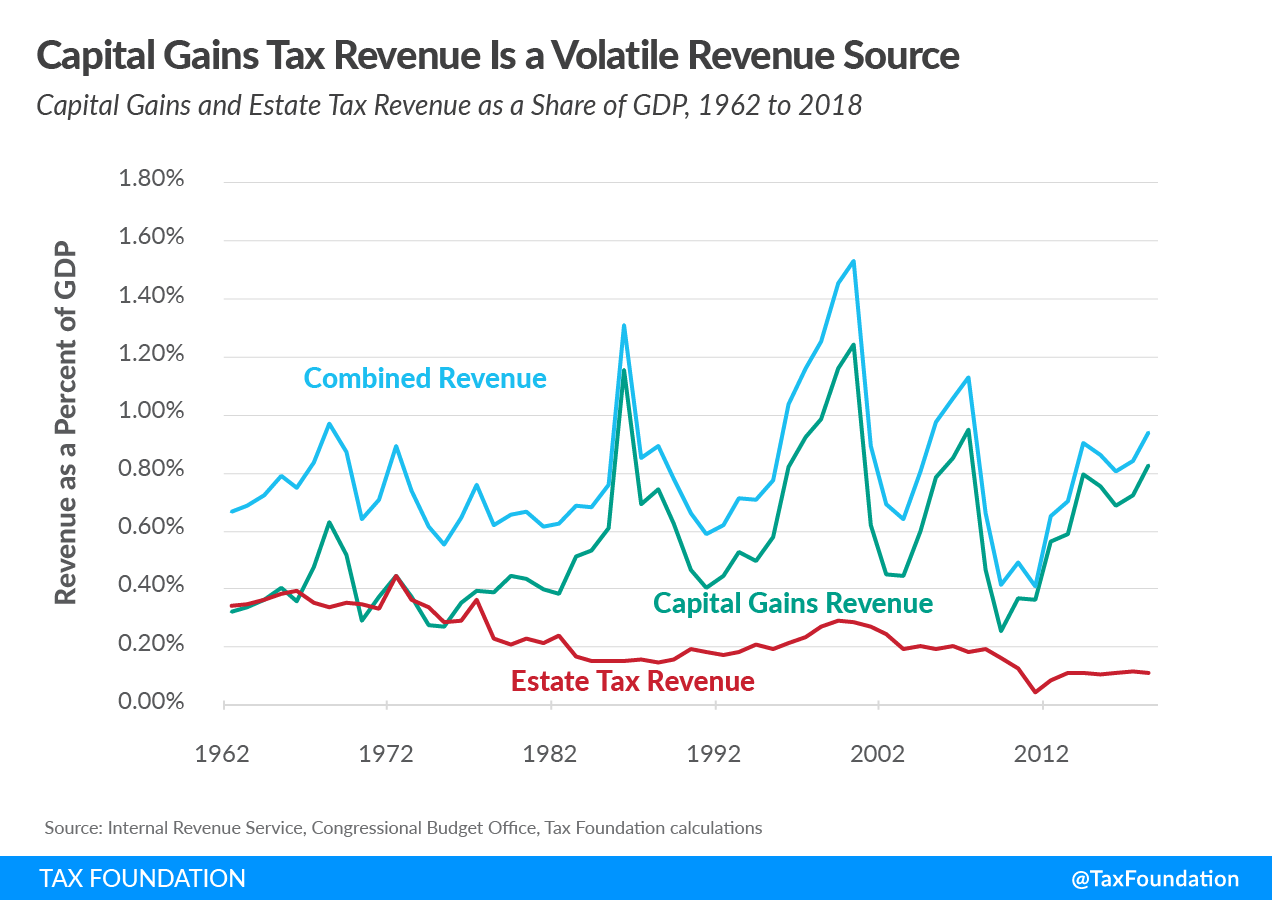

What Are Capital Gains Taxes And How Could They Be Reformed

What Is Unrealized Gain Or Loss And Is It Taxed

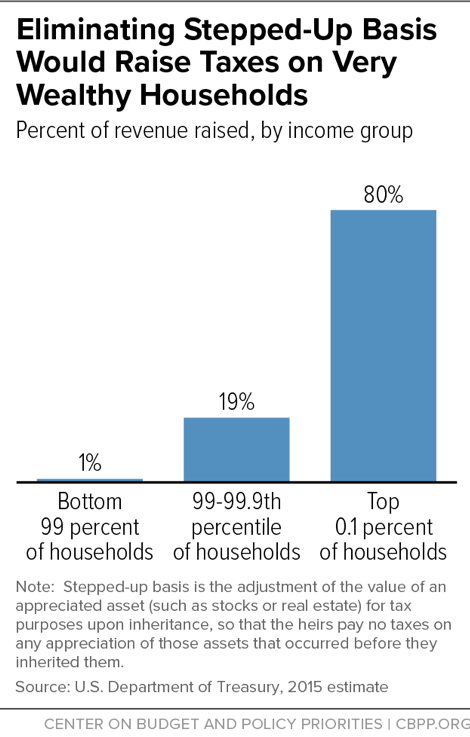

Avik Roy On Twitter Good Wsjopinion Summary Of The Constitutional Problems With The Dems New Proposed Wealth Tax On Unrealized Capital Gains Unrealized Capital Gains Aren T Income And The Constitution Only

How Elon Musk Could Pay For A Tax On Unrealized Capital Gains Barron S

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

State Taxes On Capital Gains Center On Budget And Policy Priorities

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

The Madness Of Taxing Unrealized Capital Gains Oped Eurasia Review

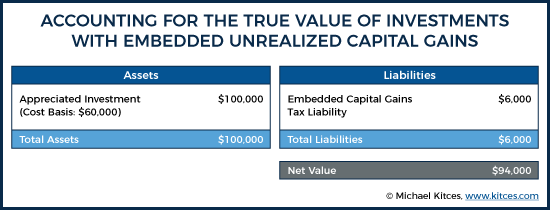

Strategies For Investments With Big Embedded Capital Gains

Opposed To The Unrealized Capital Gains Tax R Elonmusk

Democrats Unveil Plan To Tax Unrealized Capital Gains

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

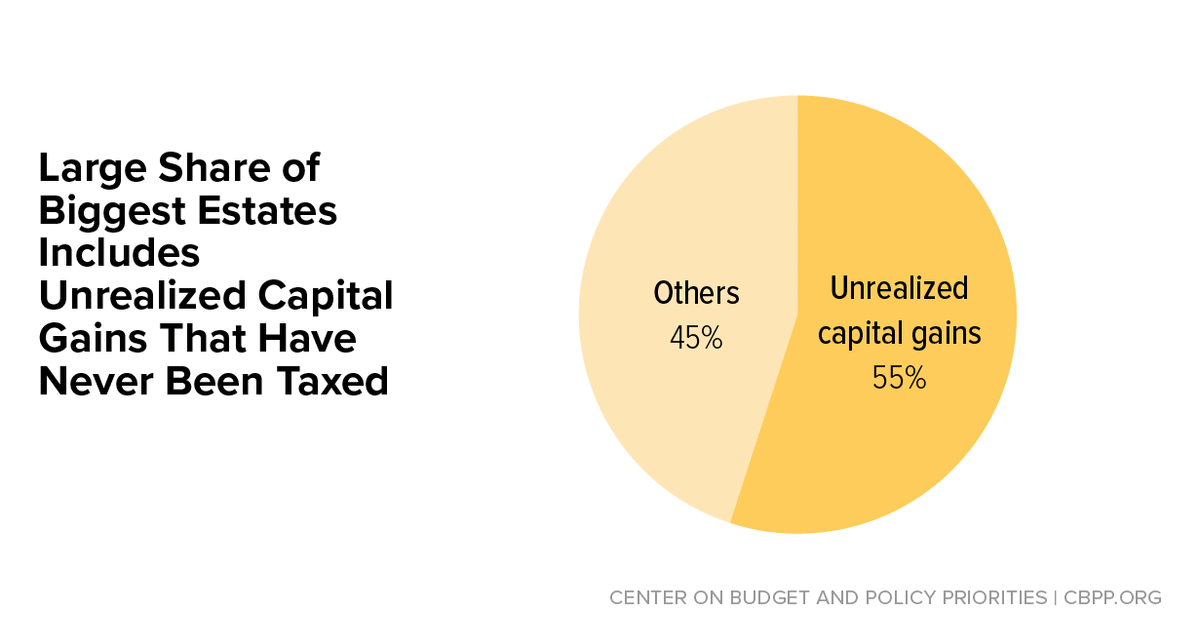

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

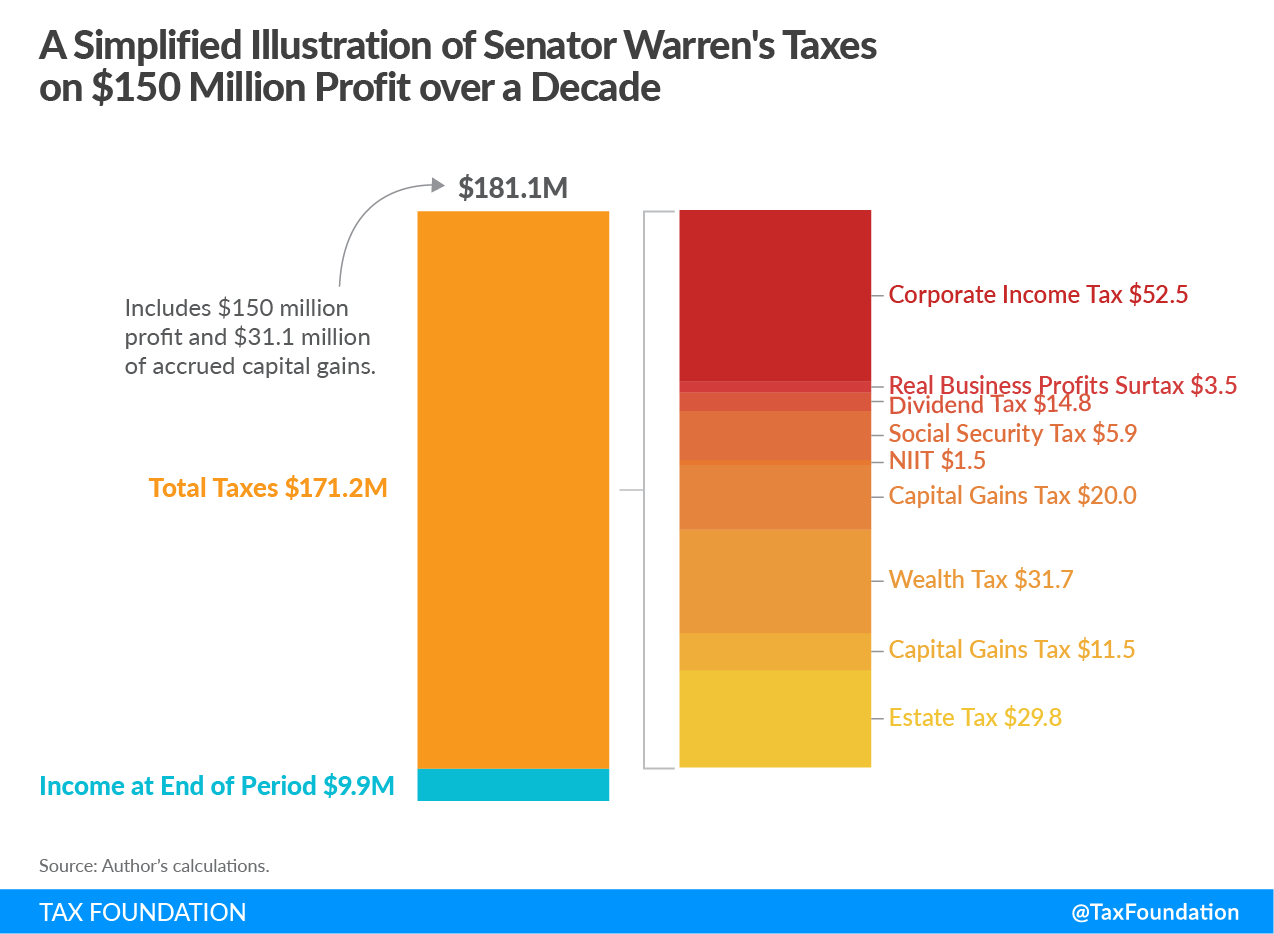

Warren S Tax Plans Could Bring Rates Over 100 Percent On Capital Income

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)